What is an Intermediary Bank?

An intermediary bank serves as a facilitator on behalf of the sending bank to process international financial transactions. For final payment instructions, you must provide the details of the beneficiary (receiving) bank, not the intermediary bank, to ensure the funds are properly directed to the intended recipient.

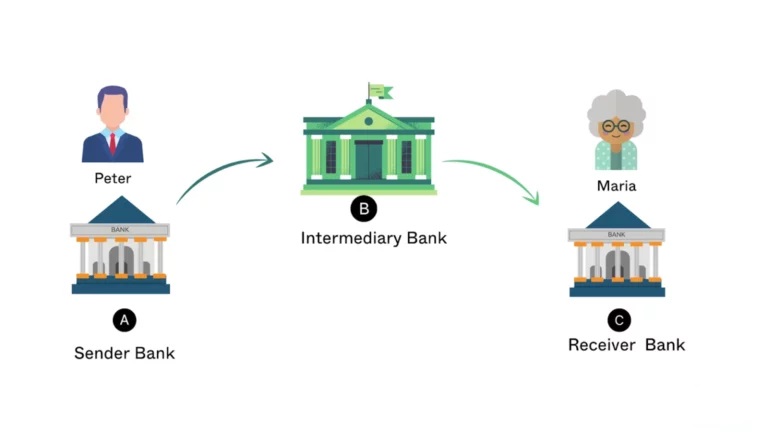

Example of an Intermediary Bank

To illustrate, consider Peter, a trader based in New York, who wishes to purchase goods from Maria, a souvenir dealer in the Philippines. This represents a cross-border transaction involving an international payment between two countries.

Peter instructs his bank (Bank A) to send funds to Maria’s bank (Bank C). However, because Bank A does not hold a direct account with Bank C, the transaction must be routed through an intermediary bank (Bank B) to facilitate the transfer of funds.

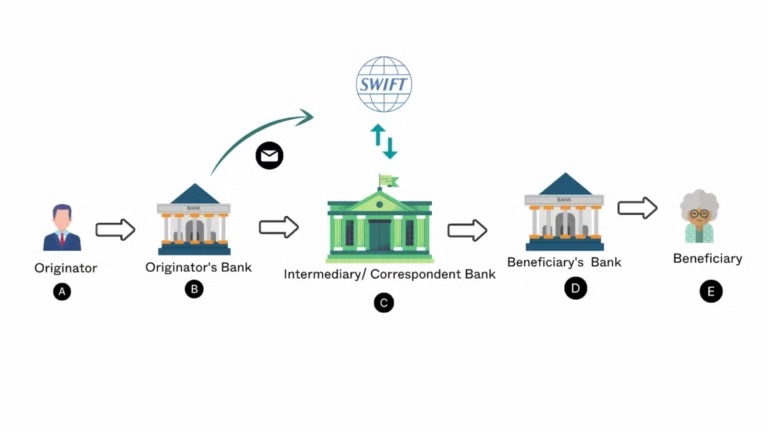

Understanding Intermediary Banks

In international money transfers, intermediary banks play a crucial role in ensuring the smooth and efficient movement of funds across borders. These transactions typically involve five key participants:

In an ideal scenario, the originator’s bank and the beneficiary’s bank maintain a direct banking relationship. When this is the case, the transaction can be processed quickly and efficiently.

However, when such a relationship does not exist, an intermediary bank is used to act on behalf of the originator’s bank to facilitate the transfer.

It is also not uncommon for multiple intermediary banks to be involved in a single transaction before the funds reach the beneficiary’s bank account.

When Is an Intermediary Bank Required?

An intermediary bank is necessary when initiating an international funds transfer between the originator’s bank and the beneficiary’s bank without a direct banking relationship. This typically occurs when the two banks do not maintain correspondent accounts with one another, making a direct deposit through the SWIFT network impossible. In such cases, the intermediary bank serves as a bridge to ensure the transaction is successfully completed.

This becomes especially important when the funds being transferred must be converted from U.S. dollars or another foreign currency into the beneficiary’s local currency, as intermediary banks often handle the currency exchange and ensure the proper routing of international payments.

What’s the Difference Between Intermediary and Correspondent Banks?

In global banking, the terms intermediary bank and correspondent bank are often used interchangeably. While both serve to facilitate international fund transfers between the originator’s bank and the beneficiary’s bank, there are key differences in terms of functionality, currency handling, and the scope of services provided.

Correspondent banks provide a wider range of services, including:

- - Foreign exchange

- - Wire transfers

- - Check clearing

This arrangement allows banks to extend their global reach without setting up operations in every country.

What Fees Are Associated with Intermediary Banks?

Intermediary banks do not charge standardized fees, which often leads to a lack of transparency in international transactions. The fees can vary based on factors such as the currency involved, routing requirements, and fixed charges imposed by the intermediary institution.

How Do You Find Intermediary Bank Information?

The sender is not required to provide or know the intermediary bank information. This information is managed between financial institutions as part of the transaction routing process. For the transfer to proceed, the sender only needs to supply the beneficiary bank’s details, including the SWIFT/BIC code and the beneficiary’s account number.

The originator bank may choose to route the transaction through a specific intermediary bank based on various factors such as regulatory requirements, efficiency, cost optimization, and geographic location. In most cases, the originator bank selects the most suitable path to ensure minimal delays and fees.

While intermediary details are not typically required from the sender, they may be disclosed upon request or as part of the transfer confirmation process.

Importance of Intermediary Banks

Intermediary banks play a crucial role in facilitating and streamlining international wire transfers between the originator’s bank and the beneficiary’s bank—particularly when no direct relationship exists between the two institutions.

These banks form part of a global banking network, enabling the smooth and efficient movement of funds across borders. They also help financial institutions optimize operations by reducing the need for maintaining multiple accounts and branch relationships in foreign jurisdictions.

In addition, intermediary banks are often responsible for conducting regulatory due diligence, which is essential for preventing fraud, money laundering, and other illicit financial activities. Their involvement helps ensure compliance with international banking standards and safeguards the integrity of the global financial system.